European stocks picked up slightly, following on from a mixed overnight scene in Asia, as President Donald Trump sought to turn the market’s attention from politics to the costly US-China trade war.

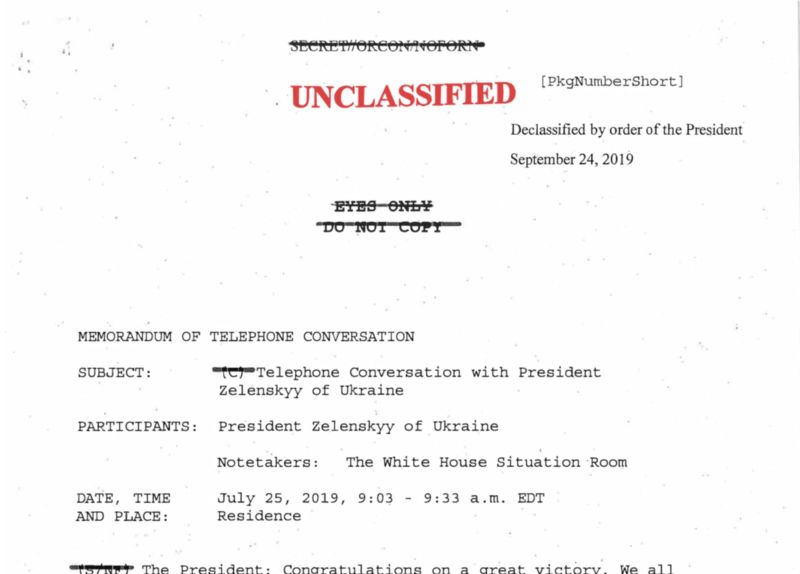

Investor conviction appears to be in short supply during recent days, including during yesterday’s session, after the White House released a transcript of Trump's phone call with Ukraine in which he asked Ukraine to "look into" former Vice President Joe Biden and his son.

In an announcement, which appeared to overshadow the impeachment inquiry, the president said an agreement to end the 15-month trade war with China could happen sooner than people think.

"We've picked up trillions of dollars and they've lost trillions of dollars and they want to make a deal very badly" Trump said on Wednesday. "It could happen sooner than you think", he added.

Trump also signed a partial trade agreement with Shinzo Abe, the prime minister of Japan, that will eliminate tariffs and expand market access on farm, industrial and digital products.

These moves look to help extend upon yesterday’s trading, where US stocks rebounded, as the market initially reacted to Donald Trump optimism over a trade deal and reviewed the transcript of the phone conversation at the center of the impeachment inquiry.

The S&P 500 ended the session +0.59% higher, led by gains in Technology (+1.19%) and Consumer Discretionary (+0.91%) shares. Meanwhile, the Nasdaq Composite gained +1.12%, and the Dow Jones Industrial Average added +0.68% to its value.

Ahead, in today’s calendar, Thursday includes; Weekly Jobless Claims, Wholesale Inventories, Goods Trade Balance and Q2 GDP data at 8:30am EST, followed by Pending Home Sales for August at 10am EST.

In earnings; Micron Technology (MU), Carnival (CCL), Conagra Brands (CAG), Rite Aid (RAD), Accenture (ACN), Progress Software (PRGS) and FactSet Research Systems (FDS) are all expected to report today.

TODAY'S TOP HEADLINES

Politics: Rough Transcript Shows Trump Pressed Ukraine to ‘Look Into’ Joe Biden and Son. (The WSJ)

President Trump asked his Ukrainian counterpart, Volodymyr Zelensky, to “look into” former Vice President Joe Biden and his son and said he would direct his personal lawyer and Attorney General, William Barr, to contact Mr. Zelensky to help him in a possible investigation, according to a document released Wednesday by the White House.

ECONOMIC CALENDAR

Today's Economical Announcements.

08:30AM - ★☆☆ - Weekly Jobless Claims (Previous: 208,000)

08:30AM - ★☆☆ - Wholesale Inventories (MoM) (Previous: 0.2%)

08:30AM - ★★☆ - Goods Trade Balance (Aug) (Previous: -72.46B)

08:30AM - ★★★ - GDP (QoQ) (Q2) (Previous: 2.0%)

10:00AM - ★★★ - Pending Home Sales (MoM) (Previous: -2.5%)

STOCKS IN THE SPOTLIGHT

Pre-Market Movers & News Related Stocks.

Beyond Meat (BYND): [NEWS] McDonald’s (MCD) is testing a new “PLT”, a plant, lettuce, and tomato sandwich, that uses Beyond Meat’s plant-based patties. The tests will take place in 28 restaurants in Canada.

Rite Aid (RAD): [EARNINGS] Earned an adjusted 12 cents per share for its latest quarter, 5 cents a share above estimates. Revenue missed forecasts, however, as did comparable-store sales.

Conagra Brands (CAG): [EARNINGS] Reported adjusted quarterly profit of 43 cents per share, 4 cents a share above estimates. Revenue was below Wall Street forecasts, with organic net sales falling 1.7%.

FactSet (FDS): [EARNINGS] Earned an adjusted $2.61 per share for its latest quarter, beating the consensus estimate of $2.47 a share. Revenue was also above Wall Street forecasts, but the company gave a fiscal 2020 earnings forecast that is below current consensus.

Accenture (ACN): [EARNINGS] Earned $1.74 per share for its fiscal fourth quarter, 3 cents a share above estimates. Earnings growth was helped by improvement in digital and cloud services. Revenue was slightly shy of analysts’ forecasts, however, and Accenture gave a current-quarter revenue forecast below estimates due to a stronger dollar.

Target (TGT): [REVIEW] Was raised to the No. 1 position on Cowen’s “Conviction List,” based on strong recent results and an improved profit margin outlook.

KB Home (KBH): [EARNINGS] Reported quarterly profit of 73 cents per share, 7 cents a share above estimates. The home builder’s revenue was below Wall Street forecasts. KB Home saw a 24% rise in net orders during the quarter.

MOMENTUM STOCKS

GAINERS: MPC, JBL, CTAS

DECLINERS: PINC

TODAY'S IPOs

Oportun Financial (OPRT) (Low: 15, High: 17) (Est. Vol: $100.0M)

Peloton Interactive (PTON) (Price: 29) (Est. Vol: $1.160B)