Oil prices remain the focus point for global markets yesterday as investors asses the impact of sharply higher prices on global demand and the geopolitical outcomes over the attack on the Saudi refining facilities. The upcoming FOMC meeting tomorrow took actually the backstage for investors yesterday, as markets expect another 25 basis points decrease to 2% on the Federal Fund Rate. FX markets traded a lackluster session, the dollar traded higher versus the Euro and Sterling and mostly sideways versus other markets. Global equity markets traded lower after a gap down over the Saudi crisis on a typical Monday session, low volumes and narrow trading ranges. Metals traded sharply higher during the morning session, then lost ground as the USD got stronger and Gold closed at $1,497.9 per ounce, marginally higher on the day. Oil trading range was the biggest in 2019 following the biggest gap ever in prices, up nearly 20% and trading as high as $63.11 per barrel and as low as $59.5, a $3.5 range. More volatility is expected today as investor assess the chances of a military retaliation versus Yemenite terrorists, assumed responsible for the attacks and ahead of US inventories numbers tomorrow. Oil closed at 61.56 per barrel, up 14% at the close.

There is no important news on the agenda Tuesday. (all times GMT).

| Global Markets 24 hours wrap-up | ||||||

|---|---|---|---|---|---|---|

| Market | GBPUSD | USDJPY | EURJPY | EURUSD | GOLD | OIL |

| 16.9.19 | -0.59% | -0.06% | -0.66% | -0.58% | 0.7% | 14% |

| USDMXN | USDCHF | AUDUSD | AUDJPY | USDCAD | Silver | Nat Gas |

| 0.23% | 0.16% | -0.15% | -0.17% | -0.29% | 2.37% | 2.52% |

| Dollar Index | DAX | FTSE100 | CAC40 | EURSXX50 | NIKKEI225 | CSI300 |

| 0.33% | -0.83% | -0.55% | -0.64% | -0.77% | 0.06% | -1.68% |

| 1 YEAR | 2.21% | 0.17% | 4.71% | 5.17% | -4.73% | 21.41% |

| Swing report | ||||||

|---|---|---|---|---|---|---|

| TRADE | ENTRY PRICE | POSITION | OPEN PROFIT | DATE TRIGGERED | STOP LOSS | UPDATES |

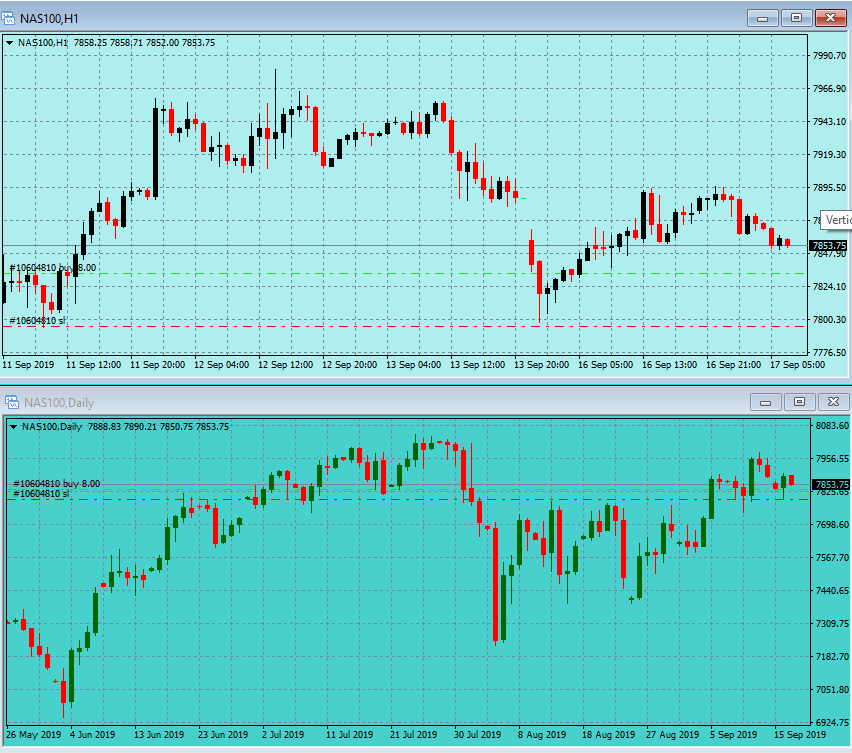

| NASDAQ | 7833 | 8 | 180 | 16/9 | 7799 | |

| DAX | 13378 | 4 | 80 | 16/9 | 12408 | new position |

| OIL | 59.5 | 8 | -400 | 16/9 | 60 | stopped out |

| GOLD | 1490 | 60 | 220 | 9/9 | 1480 | |

| OPEN PROFIT | $330 | |||||

Oil gaps up and closes 14% higher on the Saudi refining facilities attack over the weekend.

Nasdaq futures rebound after the gap down over the weekend, clear support level at lows.

Warning: The information provided on this page (“the information”) is for instructional purposes only, for enhancing your general knowledge of the capital market in general and using trading methods and the technical analysis method in particular. We hereby clarify that the company, its management, staff, shareholders and agents do not hold investment advisor licenses and/or portfolio manager licenses by any applicable law, and do not pretend to advise any person on the worthiness of buying, selling, holding or investing in securities and other financial assets. The information should not be construed to be a recommendation or opinion, and any person who makes any decision based on the information – does so entirely at their own risk. Be aware that the information cannot serve in lieu of advice which accounts for specific information and needs of an individual, and that investing in securities and financial assets may cause loss. The company, its management, staff and agents may have a personal interest in issues related to the information, and may hold specific securities mentioned in the information, or similar securities. If you use the information, you waive any claim or demand against the company or anyone acting on its behalf.