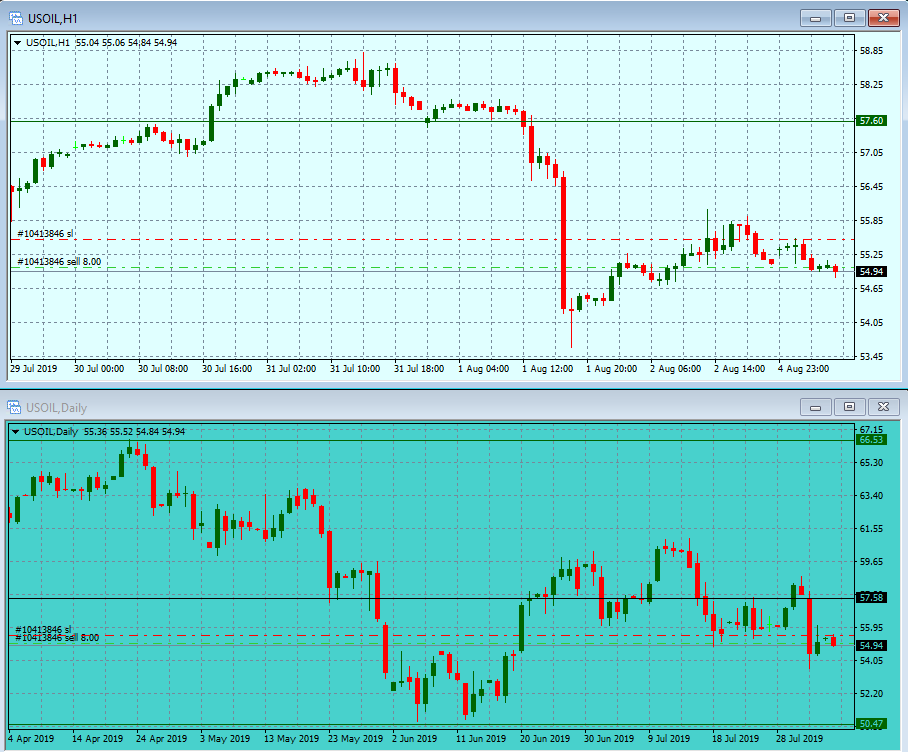

FX markets and global equity markets are opening the trading week the way they closed Friday, sharply lower, on a move to the JPY and CHF in FX markets and a move out of equities into cash and “safe heavens”. The JPY is trading this morning at 18-month highs versus the dollar, resulting in a move lower in the Nikkei by more than 2% this morning. As the trade war between US and China is heating up again, investors switch to defensive markets and opt for cash, the more obvious choices at this point are Gold and the JPY. Equities markets closed Friday the worst performing week of 2019, down more than 3% and looking at more problems this morning, on a weakening Yuan and a big selloff in Asian equity markets this morning. Gold opened the trading week near 2019 highs, trading at $1,454 per ounce and Oil opened the trading week at $55 per barrel and looking susceptible for more downside on global trade worries and a move to safety, despite the aggressive 2% plus move to the upside on Friday.

US ISM Non-Manufacturing PMI at 2:00 pm is the important news on the agenda Monday. (all times GMT).

| Global Markets 24 hours wrap-up | ||||||

|---|---|---|---|---|---|---|

| Market | GBPUSD | USDJPY | EURJPY | EURUSD | GOLD | OIL |

| 2.8.19 | 0.24% | -0.68% | -0.45% | 0.23% | 1.44% | 2.43% |

| USDMXN | USDCHF | AUDUSD | AUDJPY | USDCAD | Silver | Nat Gas |

| 0.41% | -078% | -0.06% | -0.74% | -0.02% | 0.34% | -3.13% |

| Dollar Index | DAX | FTSE100 | CAC40 | EURSXX50 | NIKKEI225 | CSI300 |

| -0.29% | -3.11% | -2.34% | -3.57% | -3.26% | -2.23% | -1.04% |

| 1 YEAR | -5.89% | -3.29% | -2.19% | -3.05% | -8.48% | 11.86% |

| Swing report | ||||||

|---|---|---|---|---|---|---|

| TRADE | ENTRY PRICE | POSITION | OPEN PROFIT | DATE TRIGGERED | STOP LOSS | UPDATES |

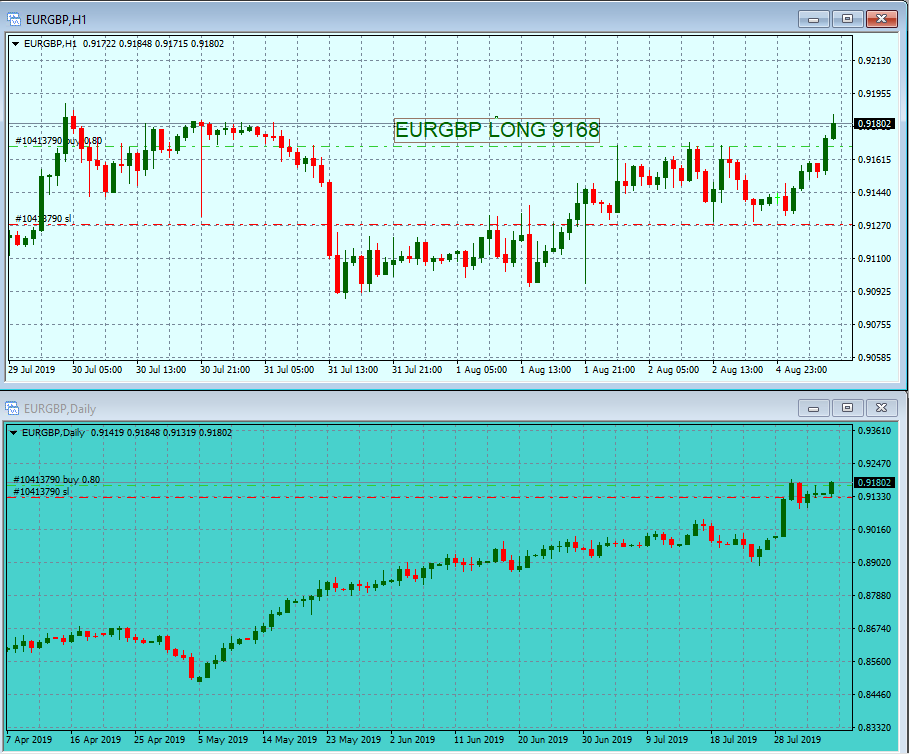

| EURGBP | 9168 | 0.8 | 120 | 5/8 | 9128 | new position |

| NASDAQ | 7593 | 8 | -80 | 5/8 | 7650 | new position |

| OIL | 55 | 8 | 40 | 5/8 | 55.5 | new position |

| OPEN PROFIT | $60 | |||||

Trade of the week: EURGBP long

OIL short following global markets weakness this morning

Warning: The information provided on this page (“the information”) is for instructional purposes only, for enhancing your general knowledge of the capital market in general and using trading methods and the technical analysis method in particular. We hereby clarify that the company, its management, staff, shareholders and agents do not hold investment advisor licenses and/or portfolio manager licenses by any applicable law, and do not pretend to advise any person on the worthiness of buying, selling, holding or investing in securities and other financial assets. The information should not be construed to be a recommendation or opinion, and any person who makes any decision based on the information – does so entirely at their own risk. Be aware that the information cannot serve in lieu of advice which accounts for specific information and needs of an individual, and that investing in securities and financial assets may cause loss. The company, its management, staff and agents may have a personal interest in issues related to the information, and may hold specific securities mentioned in the information, or similar securities. If you use the information, you waive any claim or demand against the company or anyone acting on its behalf.