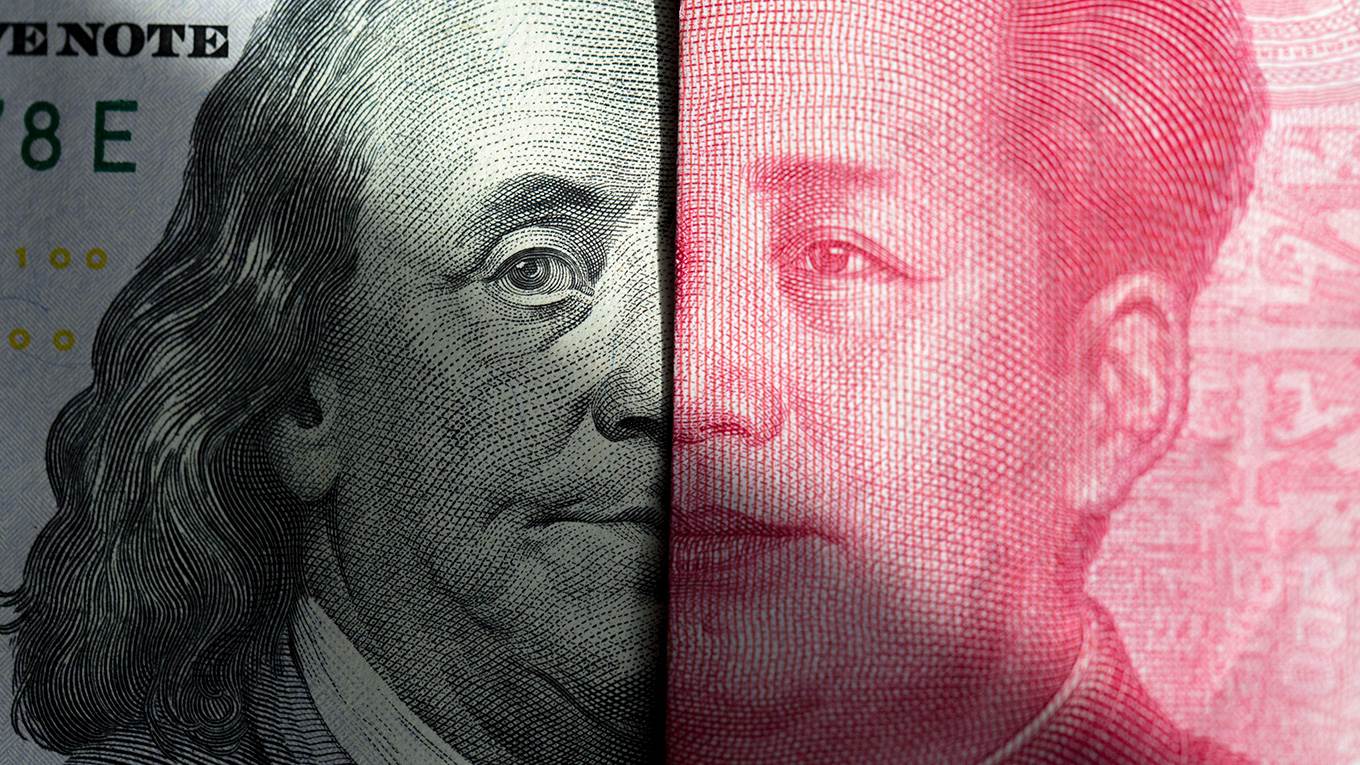

Global stocks were mixed while the dollar weakened this morning, following reports that China doubts the possibility of a comprehensive trade deal with US President, Donald Trump.

The change in sentiment came amid new questioning over a long-term trade deal between the world’s two leading economies.

Bloomberg reported that Chinese officials have warned that they won't budge on their key priorities, adding that they are concerned over Donald Trump’s impulsive decision making and the risk he may back out of the limited "phase one" accord.

Furthermore, the prospect of a mini-deal between the two countries was met with additional complications yesterday, after Chile canceled a meeting where the nations intended to sign a partial pact.

Chinese state-run media agency, Xinhua, reported that negotiators from both sides will have a phone call on Friday.

These developments come just one day after a new Wall Street record closing high, on Wednesday, where the Federal Reserve cut interest rates for the third consecutive time this year, as expected.

Fed Chair, Jay Powell, indicated that an uncertain economic outlook justified yesterday's monetary easing, adding; the possibility of a US-China trade deal and fading prospect of a no-deal Brexit could increase business confidence, raising the possibility of a pause in future cuts.

The S&P 500 closed +0.31% higher, having been down -0.20% just before the release of the US central bank’s policy decision. The Nasdaq Composite rose +0.48% higher.

Ahead, in today’s economic calendar, Thursday includes; Weekly Jobless Claims and Personal Income and Outlays for September at 8:30am EST, followed by the Chicago PMI for October at 9:45am EST.

Earnings reports are expected today from; Bristol-Myers Squibb (BMY), Kraft Heinz (KHC), Altria (MO), Dunkin' Brands (DNKN), Pinterest (PINS), Clorox (CLX), Wayfair (W), AMC Networks (AMCX), Estee Lauder (EL), Corteva (CTVA), Celgene (CELG), U.S. Steel (X), World Wrestling Entertainment (WWE), Yeti (YETI) and Qorvo (QRVO).

TODAY'S TOP HEADLINES

China & Trade: China Doubts Long-Term Trade Deal Possible With Trump. (Bloomberg)

Chinese officials are casting doubts about reaching a comprehensive long-term trade deal with the US even as the two sides get close to signing a “phase one” agreement.

ECONOMIC CALENDAR

Today's Economical Announcements.

08:30AM - ★☆☆ - Weekly Jobless Claims (Previous: 215,000)

08:30AM - ★★☆ - Personal Income (MoM) (Sep) (Previous: 0.4%)

08:30AM - ★★☆ - Personal Spending (MoM) (Sep) (Previous: 0.1%)

09:45AM - ★★☆ - Chicago PMI (Oct) (Previous: 47.1)

STOCKS IN THE SPOTLIGHT

Pre-Market Movers & News Related Stocks.

Etsy (ETSY): [EARNINGS] Matched Street forecasts with quarterly profit of 12 cents per share, while the online crafts marketplace saw revenue exceed Wall Street forecasts. Gross merchandise sales were up by more than 30 percent, but the company also saw gross margins decline by more than 3 percentage points.

Facebook (FB): [EARNINGS] Earned $2.12 per share for its latest quarter, compared to a consensus estimate of $1.91, with revenue also above Wall Street forecasts. Facebook’s average revenue per user came in at $7.26 during the quarter, higher than analysts had estimated.

Apple (AAPL): [EARNINGS] Reported quarterly profit of $3.03 per share, beating the consensus estimate of $2.84. Revenue also beat forecasts, as expanding iPad and AirPod demand and growth in services helped offset a drop in iPhone sales.

Lyft (LYFT): [EARNINGS] Lost $1.57 per share for its latest quarter, smaller than the $1.66 that analysts were anticipating. The ride-hailing service’s revenue exceeded expectations, and Lyft said it anticipated reaching profitability in about two years.

Fiat Chrysler (FCAU): [NEWS] Fiat Chrysler and Peugeot’s parent, Groupe PSA, announced their intention to work toward a binding merger agreement. The automakers’ tentative proposal which see each company’s shareholders own 50 percent of the newly combined entity.

Estee Lauder (EL): [EARNINGS] Reported adjusted quarterly earnings of $1.67 per share, 7 cents above estimates, with revenue also beating forecasts on strong results from the company’s skin care unit. However, it lowered its full-year outlook on anticipated softness in brick-and-mortar retail. Estee Lauder also raised its quarterly dividend by 12 percent to 48 cents per share.

Starbucks (SBUX): [EARNINGS] Matched Wall Street estimates with adjusted quarterly profit of 70 cents per share, with the coffee chains revenue above analyst forecasts. Global comparable store sales grew a better than expected 5 percent, helped by a jump in cold drink sales.

Cigna (CI): [EARNINGS] Beat estimates by 18 cents with adjusted quarterly profit of $4.54 per share, while revenue also came in above Wall Street forecasts. Cigna said it saw strength across all its business lines during the quarter.

Altria (MO): [EARNINGS] Beat estimates by 4 cents with adjusted quarterly profit of $1.19 per share, 4 cents above estimates, with revenue also beating forecasts. Altria also took a $4.5 billion writedown on its investment in e-cigarette maker Juul, on the possibility of further FDA actions as well as bans on e-cigarette products by various states and cities.

Twitter (TWTR): [NEWS] Will ban all political ads globally starting Nov. 22, amid growing concerns about the spread of false and misleading information.

Bristol-Myers Squibb (BMY): [EARNINGS] Came in 10 cents above estimates with adjusted quarterly earnings of $1.17 per share, with revenue above estimates as well. However, Bristol-Myers also cut its full-year guidance.

Generac (GNRC): [EARNINGS] Reported adjusted quarterly profit of $1.43 per share, 10 cents above estimates, with revenue also beating Wall Street forecasts. Generac said rolling power blackouts in California are among the key factors boosting demand for its generators.

Marathon Petroleum (MPC): [NEWS] Announced its intention to spin off its Speedway gasoline station chain into a separate, publicly traded company. Activist investor Elliott Management had been calling for a Speedway spin-off, among other moves to enhance shareholder value.

Clorox (CLX): [EARNINGS] Beat estimates by 5 cents with quarterly earnings of $1.59 per share, though revenue was slightly below forecasts. Clorox said it is still working through challenges in its bags and wraps efforts and its charcoal business, but it is growing volume and margins in three of its four business segments.

Dunkin’ Brands (DNKN): [EARNINGS] Earned an adjusted 90 cents per share for its latest quarter, 9 cents above estimates, although revenue was below forecasts. U.S. sales were helped by strong demand for Dunkin’s premium beverages like espresso and cold brew. Dunkin’ also raised its full year earnings forecast.

Ford Motor (F): [NEWS] Ford and the United Auto Workers union reached a tentative labor deal, just days after GM workers ratified a labor agreement that ended a 40-day walkout.

MOMENTUM STOCKS

GAINERS: CROX, KBR, GSX, FMC

DECLINERS: TUP, ENPH, RGNX, TCO, EXAS, BG

TODAY'S IPOs

Osprey Technology (SFTW.U) (Price: 10) (Est. Vol: $250.0M)

Oyster Point Pharma (OYST) (Low: 16, High: 18) (Est. Vol: $85.0M)

RAPT Therapeutics (RAPT) (Price: 12) (Est. Vol: $36.0M)