Stocks and Indices:

Stocks resumed their winning streak, as we welcomed some hopeful signals that the economy might skirt a recession in 2023. Consumer discretionary stocks were extremely strong too, partly thanks to Tesla’s significant uplift. Just this month, the EV company’s shares grew by 63%! The QQQ ended a very green month with a return of almost 12.4%, and the S&P 500 index gained 6.4%!

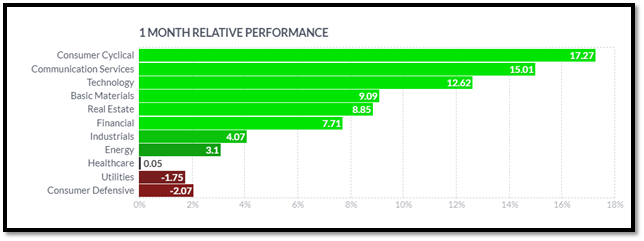

While the month was mostly green, the typically defensive consumer staples, health care, and utilities segments lagged. Relatedly, value stocks underperformed growth shares. In the following table, you can see the performance of the various sectors for January.

Last week, S&P Global reported that the composite index of current manufacturing and services sector activity climbed to 46.6, up from 45.0 in December. Despite this positive surprise, the report also showed that input prices rose in January, snapping a seven-month streak of declines.

For some companies, profits are taking a hit from the slowing economy. Microsoft, the index’s second-heaviest stock, fell sharply after the company reported a bigger-than-expected drop in profits and a drop in revenue that it expected to continue in 2023. Other weak performers included IBM and Intel. INTC shows slowing growth – 2022 is one of the only years in which Intel did not make a buyback.

Cryptocurrency:

January has got off to a very bullish start in the crypto space as investors shook off the news from the FTX fallout. Many of the top cryptos broke higher and even back to levels prior to the selloff triggered by the FTX bankruptcy.

We were able to profit from the ride higher with multiple longs. As Bitcoin (BTC/USD) lead the recovery from 17 -24k, we used long positions with Ethereum (ETH/USD), Solana (SOL/USD) and Ripple (XRP/USD). Fortunately, they made their way higher, breaking out from December ranges to reach pre-FTX highs.

The moves have been assisted by encouraging news in the sector as well as bullish speculation on the Fed possibly pausing or reducing rate hikes. Blue chip companies continued their steady investment with Mastercard launching its Web3 “Mastercard Artist Accelerator” program. In addition, we saw where several of the now-bankrupt companies affected by FTX were able to sell assets, as Investors raised funds to buy into the crypto space on the cheap.

We also enjoyed some profit on intraday shorts on ETH/USD after its first major run up and initial struggle to get past the psychological 1600 mark.

The Lunar New Year was celebrated between the 22 and 29th this month so, as expected we saw lower volatility during that period, especially during the Asian sessions. Despite this we were still able to capitalize on XRP/USD break towards the $0.43 level and now we are looking for a possible further upside move to $0.46.

This Month:

The month of February is expected to be a very interesting month with reports from companies such as AMD, SNAP, META and SONY. On the 2nd of February, we will wake up to a very fascinating day in terms of numbers when huge companies will publish their reports, such as Amazon, Apple, Google, Ford, Qualcomm and Starbucks.

Warning: The information provided on this page (“the information”) is for instructional purposes only, for enhancing your general knowledge of the capital market in general and using trading methods and the technical analysis method in particular. We hereby clarify that the company, its management, staff, shareholders and agents do not hold investment advisor licenses and/or portfolio manager licenses by any applicable law, and do not pretend to advise any person on the worthiness of buying, selling, holding or investing in securities and other financial assets. The information should not be construed to be a recommendation or opinion, and any person who makes any decision based on the information – does so entirely at their own risk. Be aware that the information cannot serve in lieu of advice which accounts for specific information and needs of an individual, and that investing in securities and financial assets may cause loss. The company, its management, staff and agents may have a personal interest in issues related to the information, and may hold specific securities mentioned in the information, or similar securities. If you use the information, you waive any claim or demand against the company or anyone acting on its behalf.